Rising Star

NEW FROM UNION COUNTY SAVINGS BANK

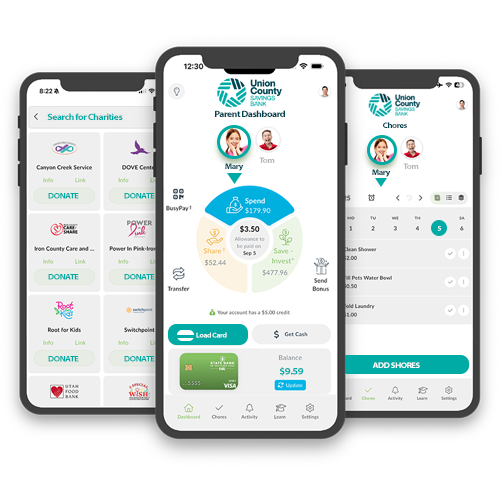

Finally, Hands-on Financial Learning for Kids with Parent Supervision!

We’re excited to introduce our UCSB Rising Star app, where you can help teach your kids to manage real money in real time. With parents serving as a safety net, children learn to be accountable for the money they receive and the way they use it. Parents monitor their child’s financial decisions, set limits, and contribute to their financial success by setting healthy parameters.

Take advantage of the next generation of banking for kids and teens with our app. Get your kids started today and let them learn a balanced financial approach to managing money.

See how UCSB Rising Star works

Learn how your family can start using the app in just a few minutes.

- Quick 1–2 minute overview video

- Perfect for parents & kids to watch together

- Simple walkthrough of earning, saving & spending

For Parents: control, visibility & peace of mind

- Set spending limits and approve money leaving the app

- Assign chores with custom amounts and due dates

- Receive alerts when your child spends, invests, or donates

- Help kids build healthy habits around money

Why parents love Rising Star

- One view of all kids’ cards

- Quick transfers from parent account

- Save, spend, donate & invest categories

- FDIC-insured funds

Frequently asked questions about the UCSB Rising Star app:

What is the UCSB Rising Star app?

The UCSB Rising Star app is a hands-on money management platform for kids and teens.

Why is the app important to use?

This app provides real-life financial practice.

Is there a cost to enroll?

No. Union County Savings Bank offers the app completely free of charge.

Can I enroll more than one child?

Yes — you can enroll up to 5 children ages 5–17.

Is the app safe?

All accounts are FDIC & insured up to $250,000.

Are parents still involved?

Yes — parents approve spending, donating, and investing.

This Union County Savings Bank Rising Star program is provided through BusyKid. The BusyKid Visa Prepaid Debit Card is issued by Pathward®,

National Association, Member FDIC, pursuant to a license from Visa U.S.A. Card and can be used everywhere Visa debit cards are accepted.

All Cardholder funds are eligible for FDIC pass-through insurance by the FDIC in accordance with the FDIC’s applicable terms and conditions

to the extent they are held by Pathward, N.A., a FDIC-insured depository institution. For more information about your card terms and conditions

including the Visa Zero Liability policy go here

PW-CHA.pdf.

Cliq® is the exclusive authorized Servicer of the BusyKid Visa Prepaid Card.

Neither Cliq nor BusyKid are banks or FDIC-insured institutions.

BusyKid’s brokerage services are offered by Apex Clearing Corporation, an SEC registered broker dealer, member of FINRA & SIPC.

This feature is optional and not affiliated with Pathward nor Visa.

† Optional feature is a BusyKid product.